Written by Nima Mohseni | Published on August 26th, 2020 | Revised on June 2nd, 2021

ITC Stepdown and Safe Harbor Overview:

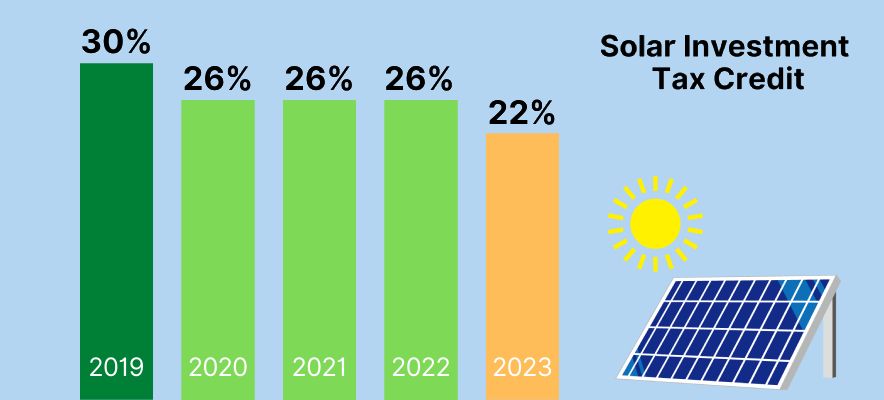

- Solar projects under construction by the end of 2022 qualify for the 26% investment tax credit

- Businesses can lock in the 26% rate if they start physical work of significant nature or incur 5% of project costs in 2021/2022.

- The credit steps down to 22% in 2023 and 10% for commercial projects from 2024 onward. This is subject to change based on future legislation.

Since the solar investment tax credit (ITC) was enacted in 2006, the U.S. solar industry has grown by more than 10,000%. The credit allows commercial entities to deduct a significant portion of the cost of their solar panel installation from their income taxes. 2021’s ITC is 26%, more than a quarter of total project costs. As of December 2020, the ITC has been extended by a year. This means that the 26% rate is also available for projects starting in 2022.

The solar investment tax credit is stepping down in the next two years, to 22% in 2023 and 10% in 2024 and beyond. For residential solar, the project must be installed and placed in service by the end of 2022 to be eligible for the 26% ITC. However, requirements for commercial projects are more lenient.

This blog post will cover the concept of safe harbor and how Capital Solar Group can help commercial projects ensure eligibility for 2021/2022’s 26% solar tax credit before it steps down to 22% in 2023.

What is Safe Harbor?

Safe harbor is the act of locking in the maximum possible tax credit, even if the system can’t be completed until the following year. The IRS has created legal methods to freeze the 26 percent ITC for future projects terminating in 2023 or even a couple of years beyond. By starting construction in 2021/2022, commercial entities can lock in the 26% ITC rate.

There are two approaches that qualify as beginning construction that will ensure a project has achieved safe harbor and has secured the tax credit for that year:

1. Incur 5% of the total project cost. A commercial solar project can say construction began on their project in 2021 if they incur at least 5% of the project cost in 2021. While 5% is the minimum required, Capital Solar Group recommends that potential system owners purchase the solar panels for the project, allowing you to safe harbor your project while also locking in pricing for your panels.

- Project costs are costs of the generating equipment, such as solar panels and other integral equipment.

- Project costs DO NOT include land costs or transmission costs.

- This option is easier to meet because it does not require continuous physical work.

2. Begin physical work of a significant nature. This refers to evidence that work has started on something relatively significant. This could refer to both on-site and off-site work, performed by a project owner, contractor, or subcontractor. This also refers to the procurement of components specific to the project, such as custom racking, carports, and transformers. There is no fixed minimum amount of work required, assuming the work performed is of a significant nature.

- Must prove that work was continuous from the start of construction to finish.

- Physical work means assembling, constructing, excavating, or manufacturing.

- Physical work DOES NOT mean design, planning, studies, securing financing, getting permits, performing tests on the land or resource, clearing the site, contouring land, or removing old foundations.

- There is no requirement that the work continues on once it starts in 2021, as long as the project is finished by the end of 2023.

How can Capital Solar Group help?

The best safe harbor strategy is dependent on the individual characteristics of your project. Capital Solar Group can help evaluate your options and determine which strategy is the best course of action to ensure you secure the maximum possible tax credit. Our experienced solar advisors will work with you to understand your project goals, timelines, and milestones, as well as your company’s financial position, accounting method, and risk profile.