Written by CSG Staff | Published on August 11th, 2021

Over the last 10 years, solar energy has become increasingly popular for commercial businesses. There are several reasons for this increase: rising and varying utility prices, massive federal and state incentives for renewable energy systems, and overall marketability, especially to customers looking to engage with businesses that have incorporated renewable energy initiatives. This has led to historic growth in the solar industry, especially in states like Maryland, Washington D.C., and Virginia.

Solar Market Trends in the Last Decade

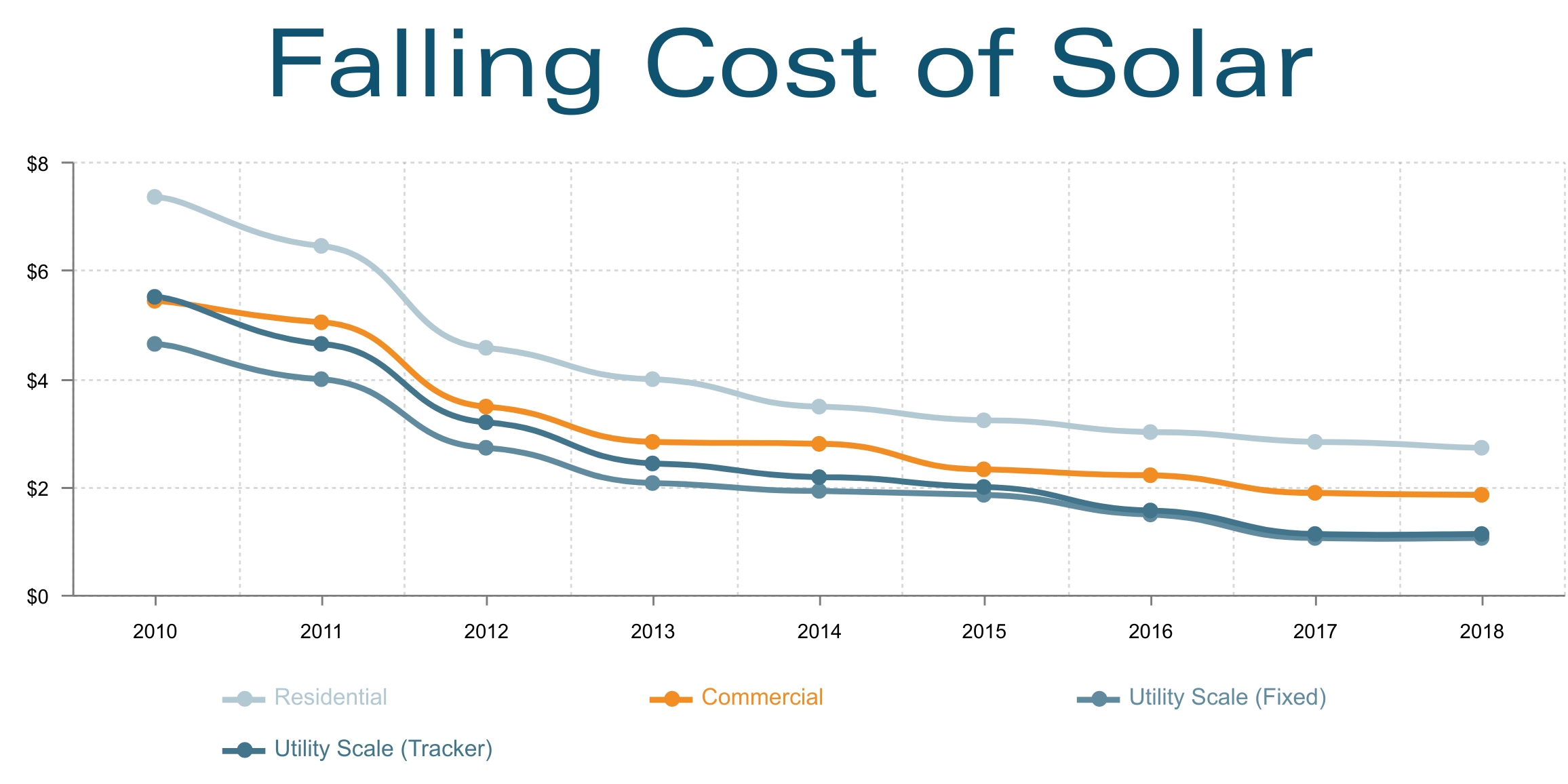

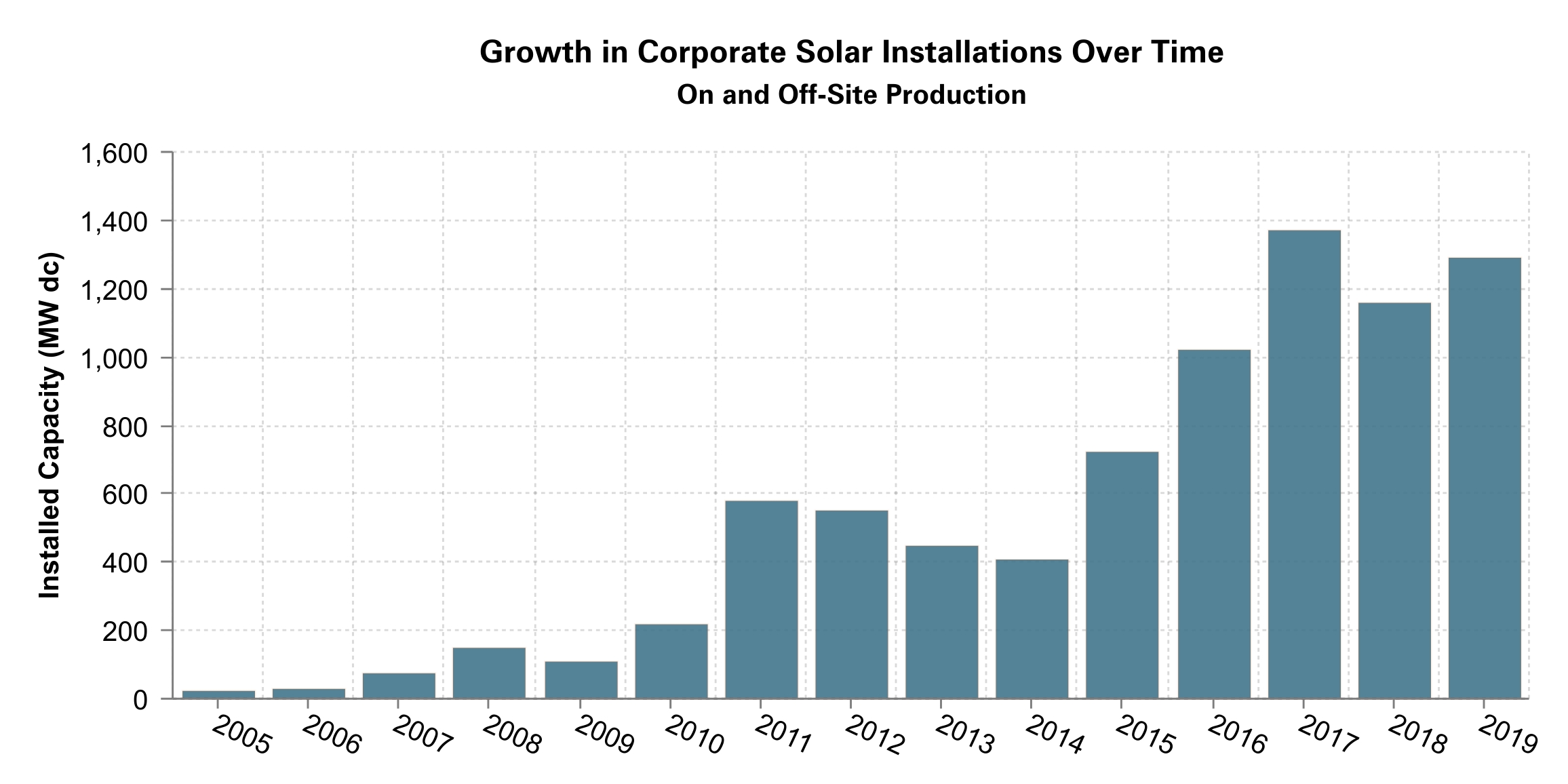

According to SEIA, “In the last decade alone, solar has experienced an average annual growth rate of 49%.”¹ Thanks to initiatives such as Solar Investment Tax Credits (ITC), and larger demands across public and private sectors, prices for installations and maintenance have declined considerably since 2000. In Maryland specifically, prices have fallen by 40% in the last five years. The total amount of solar investment in the state to date is roughly $3.34 billion which is incredibly promising for the future of renewable energy consumption in the state. Through state legislation, “Maryland has aggressively pursued alternative energy projects with a goal of generating 1,250 megawatts of electricity through renewable fuels.”² Below is a graph showing the exponential growth in Maryland solar installations:

A Larger Share of the Energy Sector

With these upward trends in solar energy installations, “Solar has ranked first or second in new electric capacity additions in each of the last 7 years. In 2019, 40% of all new electric capacity added to the grid came from solar, the largest such share in history.”³ So what does this mean for states like Maryland? Competition among other energy production technologies has put intense pressure on utility companies to work more with companies that are utilizing solar photovoltaic systems. COVID-19 has also demonstrated that renewable energy is a sustainable alternative to traditional utility consumption. Unlike fossil fuels, renewable energies like solar provide lucrative passive income opportunities that can help sustain companies that may be dealing with external issues such as declines in business revenue as a result of market volatilities.

Solar Investment Tax Credit is on the Decline

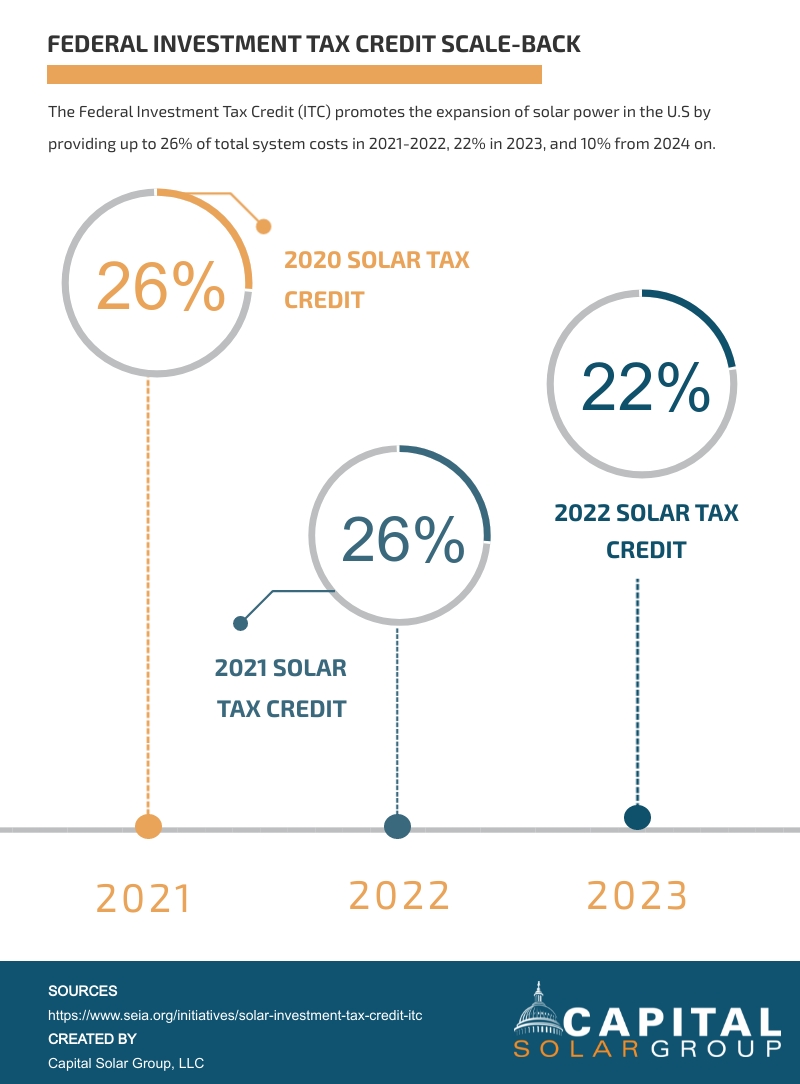

The solar ITC schedule is anticipated to be steadily declining in 3 years. Therefore, now is the best time to invest in a solar photovoltaic system. Essentially, a solar investment tax credit allows businesses to deduct a substantial percentage of the cost of installing a solar energy system. Currently, in 2021, the ITC sits at 26 percent of the installation cost and will decrease to 22 percent in 2022. Despite the stepdown, these tax credits are still substantial and may be adjusted depending on future legislation.

If your business is interested in learning more about how solar technology can help, Capital Solar Group offers free on-site preliminary consultation to measure how effective a solar PV system can be. Our dedicated financial team will work to ensure that you receive the best prices possible, including the use of ITCs and other state and federal incentives.

Sources

¹Solar Industry Research Data. (n.d.). Retrieved July 21, 2020, from https://www.seia.org/solar-industry-research-data