Written by CSG Staff | Published on July 21st, 2021

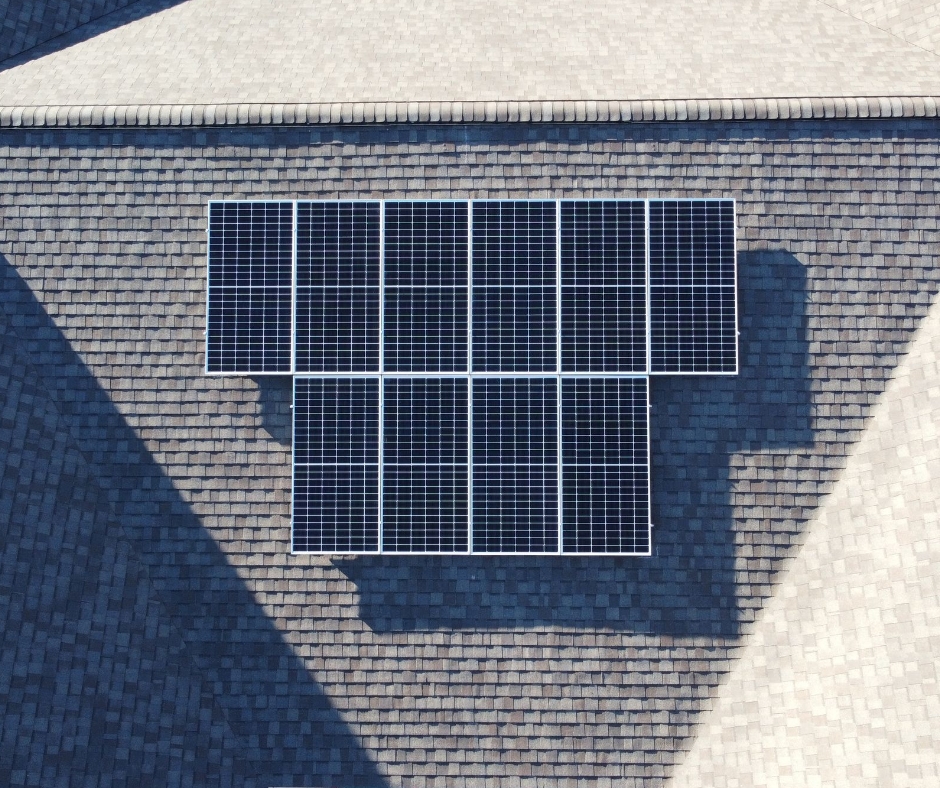

For many companies, a new roof can be a costly expense that is often put off because of immediate capital concerns. However, if a new roof is needed immediately, a solar PV system can be incredibly advantageous when trying to finance your new roof project. This article will explore and analyze the various benefits that a solar PV installation can provide for companies and businesses who are facing the difficulties that accompany commercial roofing projects.

Partial Solar Tax Credits Can Be Allotted for Reroofing

As discussed in our other article concerning Solar Investment Tax Credits (Solar ITCs), the federal government provides tax credits for solar PV projects up to 26% for the 2021 and 2022 fiscal year, and 22% for the 2023 fiscal year. Projects that qualify for the solar ITC can also include some of the costs associated with a roof installation, essentially decreasing the total cost of the installation for both the solar panel system and the new roof. There are some prerequisites for these credits, however, the financial team at Capital Solar Group will work diligently to ensure that your company or business receives the most tax incentives available. We encourage companies to take advantage of the higher credit rate of 26% this year and next by beginning the installation processes by Q4 in 2022 to ensure that the higher federal tax credit rate is utilized.

Offsetting Capital Requirements for a Roof Installation with the Benefits Associated with Solar PV Systems.

With proper coordination, certain roofing costs incurred that promote the installation of solar PV can receive the 26% federal tax credit for solar projects. Ensuring that only the roofing work that was performed for the main purpose of facilitating the installation of a rooftop mounted solar array is essential, and can qualify a portion or all of the roofing work for the solar federal tax credit. Receiving a tax credit for even a small portion of roofing expenses can be largely beneficial in helping reduce the overall costs of a project and strengthen the financial returns. Additionally, another benefit of performing roofing and solar work together is that clients gain access to the green financing programs which support the expansion of renewable energy projects such as C-PACE. By gaining access to additional financing methods, clients have more flexibility to choose a path that best fits their company’s needs.

Solar PV systems are incredibly beneficial when it comes to providing passive income, unique marketing opportunities, reductions in utility costs, and increased value in real estate property.

- SRECs allow businesses and companies to buy and sell packages of electricity through intrastate trading markets. These SRECs provide businesses with opportunities to make consistent passive income with excess electricity that is produced by solar PV systems.

- Solar power has also become very attractive for customers who are looking to engage in business with companies who are environmentally conscious, as well as companies that make financially stable decisions; such as investing in renewable energy.

- Utility costs can be extremely expensive operating costs and solar technologies provide energy independence, especially for companies that have higher utility rates. For many companies, the addition of a solar PV system means drastically reduced electricity costs, and coupled with improved insulation from a new roof, these costs can be fully diminished.

- Finally, a new roof can often be a lucrative selling point when a company is deciding whether or not to sell a real estate property. Even more so, coupling a new roof with a solar PV system can mean a great increase in real estate value for owners.

At Capital Solar Group, we help businesses follow through on incorporating solar PV systems into their new roofing projects. Our experienced solar professionals will ensure that your system is designed efficiently and installed in a timely manner. By acknowledging that every project is different, Capital Solar Group makes it a top priority to ensure that all roofing warranties are maintained throughout the solar installation process. Additionally, our in-house financial advisors will also ensure that your company or business receives all pertinent tax credits.